A career as an insurance agent can be both exciting and rewarding – it gives you opportunities to make a positive impact on people’s lives. By acting as an expert resource person, you can help clients make smart decisions when choosing the coverage best suited for their needs.

But what does it take to be one?

If you feel like a career in insurance sales is a great fit but don’t know where to start, then you’ve come to the right place. Here, Insurance Business will give you a step-by-step guide on how to become an insurance agent. We will also answer the most common questions aspiring agents ask about the profession. Read on and get your insurance sales career going.

Insurance agents act primarily as intermediaries between potential insurance buyers and the insurers. They represent one or several insurance companies and provide customers with information about these insurers and their products.

Insurance agents also have contracts with carriers detailing what policies they’re allowed to sell and the amount they can expect to make from selling these policies.

There are two types of insurance agents:

These industry professionals represent just a single insurance carrier. They can work either full-time for an insurance agency or as an independent contractor.

Captive insurance agents may receive operational backing from their partner insurers, including office space and administrative support. They may also get referrals and leads on potential buyers.

Independent insurance sales professionals work with several partner insurers. And since they’re not tied down to one insurance company, they can offer clients a wider selection of policies.

Generally, independent insurance agents earn higher commissions than their captive counterparts. But there’s a caveat – they often shoulder their own business costs, including office supplies, rent, and marketing expenses.

All insurance agents, whether captive or independent, have the power to bind coverage, something that separates them from most insurance brokers. This means they have the authority to confirm that coverage is in place even if the policy hasn’t been finalized yet.

If you want to pursue a career as an insurance agent, there are several requirements that you must meet. Here’s a step-by-step guide on how to become an insurance agent:

Each state imposes varying eligibility criteria, but in general, aspiring insurance agents must:

Some states also require candidates to not have any past-due child support to qualify.

While you don’t need a college degree to be an insurance agent, many insurance companies and agencies prefer candidates who earn one. This is because a degree helps build a solid foundation for your insurance career.

Studies focused on financial services, business administration, economics, accounting, marketing, and business law can provide useful insights into the insurance industry.

Psychology, sociology, and communications courses can also help develop some of the skills necessary to be successful.

Although not that common, some colleges and universities offer bachelor’s degrees in insurance and risk management.

If getting a degree isn’t for you, you can also get the necessary training with insurance companies. Some insurers provide internships and training programs to give aspiring agents valuable learning experience.

These programs also allow you to obtain first-hand insight into how an insurance company operates. Perform well and you may have job opportunities waiting for you within the firm.

But before you can legally sell policies, you must get a license from your state’s insurance regulation department. Each state imposes different licensing requirements but in general, you must:

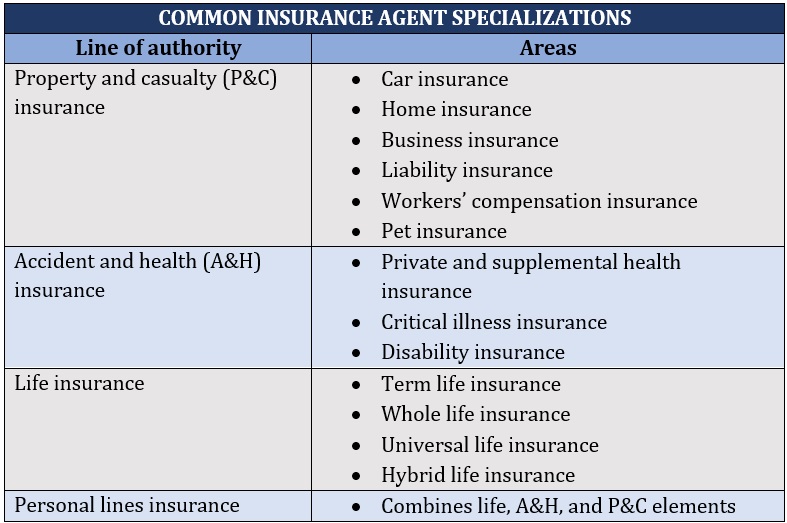

If you want to become an insurance agent, you’re required to complete a pre-licensing course to prepare for the state licensure examinations. This involves choosing a line to specialize in. Here are the most common specializations:

You can take pre-licensing courses online or in a classroom setting. The subjects come with mandatory minimum hours detailed below:

After completing the pre-licensing coursework, you can now take the state licensure exam. The tests are divided into LA&H and P&C.

Each test consists of around 50 to 200 items and must be completed in two to three hours. You’re only required to take the exam for the line that you plan on specializing in. But if you wish to practice in both, then you must pass both tests.

The passing scores vary in each state. But typically, you must get at least 70% of your answers correct to pass.

The results are valid for two years, so you must apply for a license within that span. If you fail to do so, you will be required to retake the exam to regain your eligibility.

Once you pass the test, you can apply for an insurance license. You can submit your license application to your state’s insurance regulation department. Wait at least 48 hours after passing the test to give the department enough time to process the results.

You can fill in the application form on the department’s website. You also need to pay a license fee, which varies in each state. If you’re applying for licenses for different specializations, you will need to pay separate fees.

The insurance regulation department reviews all license applications. There’s no specific timeframe for this as each application is treated differently.

If something comes up from your background check, the department may contact you to provide clarity. This can slow down the process.

You can find out if your application has been approved or denied through the department’s website. If approved, you can request a PDF copy of your license. Some states don’t mail printed licenses, so you may need to download and print the insurance license yourself.

You can find out how long it takes to get an insurance license in this guide.

Congratulations! Now that you have your insurance agent license, it’s time to chase your dream job. This list of the best websites to search for insurance jobs can help make the task easier.

Most states require that you take a minimum of 24 hours of continuing education (CE) credits during a two-year term to maintain your insurance license and keep your skills updated. These often include three hours of ethics training.

Insurance agents make a living primarily through commissions. However, there are several other ways these professionals can earn an income. Here are the different ways an insurance agent makes money:

Most insurance agents get paid through commissions. The commission amount depends on a range of factors, including:

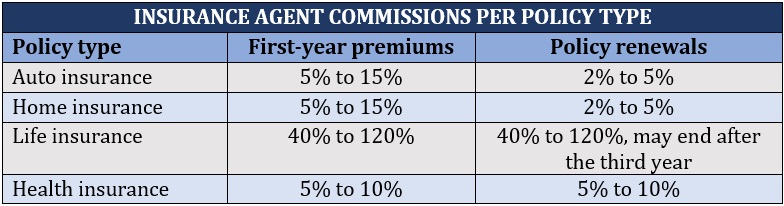

If you’re a captive insurance agent, you can earn about 5% to 10% of the entire premiums paid for the first year for every new auto and home policy you sell. Meanwhile, an independent agent receives about 15%.

For renewals, commission rates range between 2% and 15%, averaging around 2% to 5%, regardless of whether you’re captive or independent.

Here’s a guide on how much car insurance agents make.

Life insurance agents get front-loaded commissions of 40% to up to 120% of a policy’s first-year premiums. This is the highest in the industry. The rates for renewals, however, drop to just 1% to 2%. Some agents no longer receive commissions after the policy’s third year.

You can learn more about how much life insurance agents make in this guide.

Commission rates will vary depending on your partner insurer if you choose to be a health insurance agent. The average is between 5% and 10% of the policy’s total premiums in the first year.

If you’re selling group policies, you may earn slightly lower commissions of around 3% to 6%. Group plans, however, are often purchased by businesses for their staff so you can generate up to four- or even five-figure earnings per company, depending on the number of employees.

If you want to know how much health insurance agents make per policy, this guide provides the details.

Here’s a summary of the commissions you can receive for the different types of policies.

Captive insurance agents often work as full-time salaried employees for insurance companies. But depending on your contract, you may receive commissions apart from your fixed wages.

Salaried insurance agents only make the amount they have agreed to with the insurer or agency for that given year. Your performance, however, still depends on how many sales you can close.

Some insurance companies implement profit-sharing programs for their partner agencies. If you’re part of an insurance agency that has achieved certain revenue targets, the insurer typically rewards the agency with a percentage of either written or earned premiums as a bonus.

You can find the complete details of how much insurance agents make in this comprehensive guide.

Pursuing a career as an insurance agent comes with its share of pros and cons. Here are some of the profession’s benefits and drawbacks:

Because insurance is a constantly evolving sector, you will often face challenges that will require you to find creative and innovative solutions. This can give you a sense of fulfillment at the end of the day.

Apart from licensing requirements, there are very few entry barriers if you want to pursue a career in insurance sales. Although many insurers prefer candidates with a college degree, the role itself doesn’t require one. Many insurers provide training and mentorship programs to new hires.

Because your income will mostly be commission-based, there can be no limit to how much you earn. If you have a great work ethic and are willing to place yourself out there to establish good relationships with clients, more opportunities to earn a higher income will come your way.

Insurance will always be in demand as long as people need financial protection. This includes when they are driving their cars, purchasing properties, seeking medical treatment, and operating businesses.

Flexible work hours

If you choose to become an independent insurance agent, you can enjoy the freedom of setting your own work schedule. You will also have plenty of opportunities to sell insurance from home.

Having a commission-based role also has its drawbacks. Since your income is based on the number of sales you close, it can be difficult to predict how much your next paycheck will be. And if you don’t push yourself hard, your earnings will also reflect that.

Finding good leads is the lifeline of an insurance agent’s career. But it is also the biggest challenge given the highly competitive market. There’s a strong chance that the leads you find may have already been contacted by several other agents.

You may need to work long hours to meet different targets and quotas. This high-pressure work environment can lead to stress and burnout, especially if you’re just learning the ropes.

There are some people who treat agents with disdain and disrespect. In your daily work, you will encounter people like them. You may also receive a lot of nos before getting a yes, so having a resilient nature and excellent interpersonal skills are important for your success.

Another factor that can help you succeed as an insurance agent is having the right role models. Look no further – we recently unveiled our five-star awardees for The Best Insurance Professionals Under 35 in the USA. Some of these rising stars started their careers in the industry as insurance agents. Find out in this special report what it took for them to achieve success.

Did you find our guide on how to become an insurance agent helpful? What aspect of the job are you most looking forward to? Chat us up in the comments section below.